|

FULL SITE RETURNING SOON

Listen to or watch new episodes of Asbury Radio at the Asbury Radio Facebook page or catch the replay below when it becomes available. Please e-mail asburyradio@maureennevin.com and let Maureen know what you'd like her to include in the discussion on future shows. Replays of the weekly show are available to stream here on demand.

Asbury Radio 2025-03-26

Asbury Radio 2024-12-06

Asbury Radio 2024-11-09

Asbury Radio 2024-11-01

Asbury Radio 2024-10-25

Asbury Radio 2024-10-01

Asbury Radio 2024-09-20

Asbury Radio 2024-09-06

Asbury Radio 2024-08-23

Asbury Radio 2024-08-16

Asbury Radio 2024-08-09

Asbury Radio 2024-08-02

Asbury Radio 2024-07-12

Asbury Radio 2024-07-05

Asbury Radio 2024-06-28

Asbury Radio 2024-06-21

Asbury Radio 2024-06-14.mp3

Junior Bernard was destitute in Haiti. Then he met the Barr family. Read about his story and listen to the Aug. 2 show with guest Junior Bernard.

The Arthur Pryor Bandshell's neglect and subsequent deterioration, then ultimate demolition were a painfully slow and heartbreaking period for residents and visitors alike. The Asbury Park Concert Band played on and in the summer of 2024, the bandshell returned to its iconic location atop the Fifth Avenue Pavilion.

Read Maureen's full story in the Asbury Park Reporter.

Below, Asbury Park music legend Dorian Parreott entertains at a recent performance of the Asbury Park Concert Band.

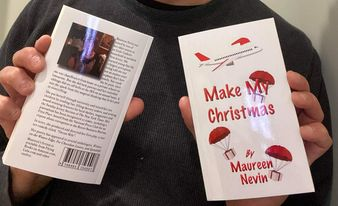

My first book is a pocket-sized, dark humor novella titled "Make My Christmas." First in my Flying Books series, a fast read and perfect length for a flight to visit the family units. It's been available as an eBook for several years. Time enough to gather nice reviews on Amazon. Available in print from Lulu.com.

|

ASBURY RADIO T-SHIRTS?

|